Nonprofit revenue may be unearned revenue earned through fundraising occasions or unsolicited donations. For instance, internet earnings incorporates bills similar to value of goods sold, promoting, general, and administrative expenses, operating expenses, depreciation, interest, taxes, and other expenses. While revenue is a gross amount centered just on the collection of proceeds, income or profit reviews the net proceeds. It is the measurement of solely the income part of an entity’s operations.

Accounting Providers

Until the corporate fulfills this obligation, the quantity is recorded as a liability. Once the service or product is delivered, the legal responsibility is eliminated, and the cost is acknowledged as revenue. Once the products or services are delivered, the unearned revenue balance sheet entry is transformed into income as the worth in return for the payment obtained is delivered. Advance funds assist corporations and people with cash flow and other quick payments which makes the production process sooner.

The money that you just receive from your buyer before you’ve offered a product known as unearned income. Let us understand how unearned revenue steadiness sheet documentation is carried out with the assistance of some examples. These examples will give us extra relevance as they have been curated keeping daily conditions in mind. Let us understand the steps concerned in the unearned income steadiness sheet entry through the detailed step-by-step course of below. You will, due to this fact, have to make two double-entries in your business’s information in relation to unearned revenue, as soon as when it is obtained, and again when it is earned. Under ASC 606, companies should recognize income only once they full a service or deliver a product.

Is There A Difference In How Unearned Revenue Is Treated For Small Vs Giant Businesses?

The unearned revenue account might be debited and the service revenues account shall be credited the identical amount, in accordance with Accounting Coach. Revenue is the cash earned by an organization obtained primarily from the sale of its services or products to customers. There are specific accounting rules that dictate when, how, and why a company recognizes revenue. Nonetheless, a company might not be capable of recognize revenue till it has performed its part of the contractual obligation. There are different ways to calculate income, relying on the accounting methodology employed.

Retailers also use prepayments for high-demand objects, similar to new smartphones, gaming consoles, and luxury goods. This mannequin helps companies predict demand, manage supply chains, and safe funds earlier than manufacturing is full. Since they overlap completely, you’ll be able to debit the money journal and credit score the revenue journal. Sensible Dashboards by Baremetrics make it straightforward to gather and visualize all of your gross sales data. Then, you’ll always know the way a lot money you’ve readily available, which purchasers have paid, and who you still owe companies to.

- Every time a portion of the service or product is delivered, the accountant makes a journal entry shifting the suitable quantity from unearned revenue to a revenue account on the earnings statement.

- Unearned income refers to income your company or business obtained for products or services you are yet to ship or present to the buyer (customer).

- Every month, as soon as James receives his mystery boxes, Beeker’s will remove $40 from unearned revenue and convert it to revenue as an alternative, as James is now in possession of the products he purchased.

- The income recognition precept dictates that income should be acknowledged when it is earned, no matter when payment is obtained.

- You report pay as you go income as quickly as you receive it in your organization’s balance sheet however as a liability.

On July 1, Journal Inc would document $0 in revenue on the income assertion, since none of the money has been earned yet. Cash on the balance sheet would enhance by $60, and a legal responsibility referred to as unearned revenue would be created for $60 to offset it. As Quickly As an organization delivers its final product to the customer, only then does unearned income get reversed off the books and acknowledged as income on your profit and loss assertion. In truth, plenty of common gadgets customers purchase are based on this fee system similar to subscription-based merchandise, airplane tickets, prepaid insurance coverage, retainers to attorneys, and so on.

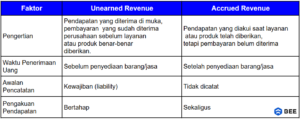

Unearned revenue and earned revenue represent two different stages in the income recognition process. Unearned revenue is money acquired earlier than delivering a services or products, while earned income displays revenue from accomplished obligations. Unearned income isn’t an uncommon liability; it can be seen on the stability sheet of many companies https://www.quickbooks-payroll.org/.

The initial entry for this legal responsibility is a debit to money, and a credit score to the unearned income account. $5 would be recorded as income on the income statement, and the unearned income liability could be lowered by $5 to offset it. On 31st May, a contractor received $100,000 for a project to be executed over ten months. The $10,000 could be recognized as revenue for the next ten months within the contractor’s books. The total quantity acquired could be recorded as unearned earnings because the project is but to be completed.

Creating and adjusting journal entries for unearned revenue might be easier if your business makes use of the accrual accounting technique when recording transactions. Basically, when the cash is out there in, you report it as a credit score within the ‘unearned revenue’ column and a debit in your cash account. When the service is delivered and you’ve got earned the income, you record one other double entry with credit score and debit reversed.

Monetary Evaluation And Transparency

This kind of income creates a legal responsibility that needs to be settled when the corporate lastly delivers the products or services to the client. Utilizing journal entries, accountants document the transactions involving unearned income in an organized manner. Accounts receivable represents money that you’re owed for work that has already been completed and has been invoiced and awaiting cost by your customer. Unearned revenue is money that you’ve been paid for work that has but to be carried out.

Morningstar increased quarterly and month-to-month invoices however is much less reliant on upfront funds from annual invoices, which means the steadiness has been rising extra slowly than prior to now. Although it’s a liability, having a deferred income steadiness in your books isn’t essentially a bad thing. There are a number of elements that cut back income reported on a company’s financial statements in accordance with accounting pointers.